Promo Mechanics

- This promo is open to new and existing individual and corporate subscribers to Unit Investment Trust Funds (UITFs) of BPI Asset Management and Mutual Funds (MFs) of BPI Investment Management Inc. Investments made by and in Segregated Portfolio accounts and via BPI Bills Payment or other third-party payment facilities do not qualify.

- Promo period is from September 1, 2022 – November 30, 2022. Only investments made within the promo period are qualified.

- Client must invest a minimum of PHP 1,000,000 or USD 20,000 in any of the participating BPI Investment Funds. Every PHP 1,000,000 or USD 20,000 investment entitles client to PHP 1,000 Giftaway eGC. There will be a limit of PHP10,000 worth of Giftaway eGC per client.

List of participating BPI Investment Funds:

- All BPI Invest and Odyssey funds except BPI Invest Money Market Fund, ABF Philippines Bond Index Fund, BPI Fixed Income Portfolio Fund-of-Funds and BPI Invest Bayanihan Balanced Fund

- All ALFM Mutual Funds, Ekklesia Mutual Fund and Solidaritas Fund

Terms & Conditions

- For the purpose of this promo, the investment/s of a qualified client will be subject to a ONE-YEAR HOLDING PERIOD. If client redeems fully/partially prior to the end of the holding period, BPI Asset Management &/or BIMI reserves the right to deduct the amount of the prize received from his redemption proceeds.

- Investments should only be fresh funds contributed to any of the participating BPI Investment Funds.

- Switching of funds is strictly not allowed (e.g. if a client has an existing UITF/MF account, he cannot redeem/terminate this particular UITF/MF account for reinvestment to any of the participating BPI Investment Funds for the purpose of joining this promo. Further, switching of qualified investment/s to another fund within the holding period will be treated as redemption and will be subject to the deduction of the corresponding amount of prize received from his proceeds).

- Combining of transactions and pooling of funds are strictly not allowed (e.g. client cannot combine his existing UITF/MF investments. Only 1 fund is allowed per transaction).

- To participate, clients must send their entries within the promo period, as follows:

- For online subscriptions: Client must forward the confirmation e-mail of the investment subscription with subject title: 2022 IRT Online Entry to bpiamtcpromo@bpi.com.ph (for UITFs) and to bimi_promo@bpi.com.ph (for MFs) together with their complete name and investment account number. BPI Asset Management &/or BIMI will confirm receipt of promo participation within 5 business days via email.

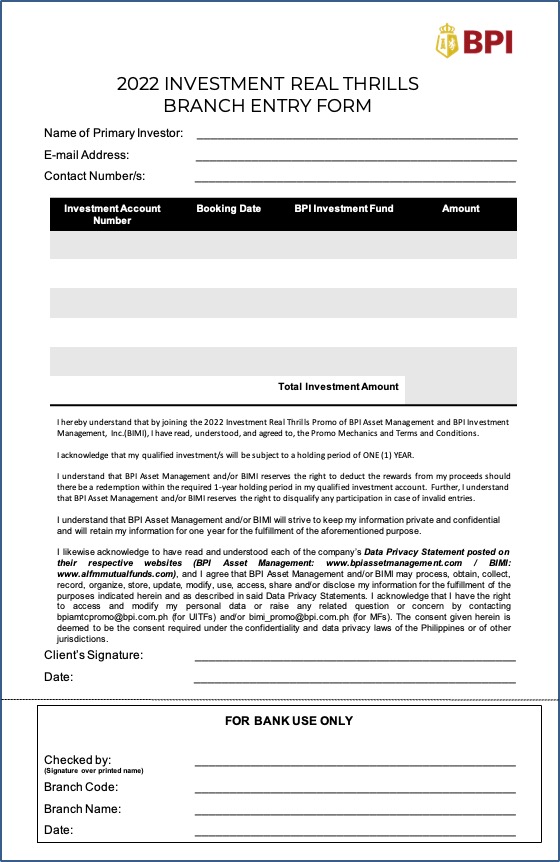

- For branch transactions: Client needs to fill out the 2022 IRT Branch Entry Form in the branch. Branch front liners must encode client’s entry along with the scanned copy of the accomplished 2022 IRT Branch Entry Form in the Microsoft Form link (https://bit.ly/2022IRTBranchEntries).

- Validation of entries for qualified clients will be done monthly following the schedule below. Amount of investment as of validation date will be the basis for the qualification and corresponding rewards.

| Entries entered during the Period | Validation Date | Holding Period |

| September 1 to 30, 2022 | October 19, 2022 | October 19, 2022 to October 19, 2023 |

| October 1 to 31, 2022 | November 17, 2022 | November 17, 2022 to November 17, 2023 |

| November 1 to 30, 2022 | December 16, 2022 | December 16, 2022 to December 16, 2023 |

- BPI Asset Management and/or BIMI will notify the qualified client directly via email (for online subscriptions) and through their Relationship/Branch Managers (for branch transactions). Should the client disagree with the Terms and Conditions of the promo, he/she must send a non-conformity email to bpiamtcpromo@bpi.com.ph (for UITs) and bimi_promo@bpi.com.ph (for MFs). Should this be the case, BPI Asset Management &/or BIMI reserves the right to disqualify the client’s participation in the promo.

Terms and Conditions for Disqualification. An entry is deemed disqualified if:

- Redemption or reinvestment is identified in the participating account

- Investment was done before or after the promo period

- Investment is part of another promo

- RSP subscription

- Subscriptions made via BPI Bills Payment or other third-party payment facilities

- The Giftaway eGC is non-convertible to cash.

- By joining this promo, the qualified participant agrees for BPI Asset Management &/or BIMI to collect information such as financial information for purposes of processing his/her registration to the promo.

- Investments, which are basis for qualification to this promo, will not be qualified for other ongoing promos of BPI Asset Management &/or BIMI.

- BPI Asset Management &/or BIMI, in concurrence with DTI, reserves the right to dispute the eligibility of participation in the promo if redemption or reinvestment is identified. In case of dispute, the decision of BPI Asset Management &/or BIMI will be final.

- BPI Asset Management &/or BIMI, in concurrence with DTI, reserves the right to terminate, discontinue or suspend the promo at any time.

Per DTI-Fair Trade Permit No. FTEB-149175 Series of 2022.

DISCLAIMER:

A Unit Investment Trust Fund (UITF) is regulated by the Bangko Sentral ng Pilipinas (BSP). It is a ready- made investment that pools funds from various investors with similar investment objectives and are invested in various financial instruments. Due to the nature of the investment, yield and potential yields cannot be guaranteed. Any income or loss arising from market fluctuations and price volatility of securities held by a UITF, even if invested in government securities, is for the account of the investor/trustor. As such, units of participation of the investor/trustor in a UITF, when redeemed, may be worth more or be worth less than his/her initial participation/contribution. Historical performance, when presented, is purely for reference purposes and is not a guarantee of future results. BPI Asset Management and Trust Corporation (BPI AMTC) is not liable for losses, other than due to willful default, evident bad faith or gross negligence. Investors are advised to read the Declaration of Trust of the relevant UITF before deciding to invest. For inquiries and comments, visit the BPI AMTC website or call us at (02) 8580-AMTC (2682).

A mutual fund is an open-end investment company registered with the Securities and Exchange Commission (SEC) in which the investible cash of numerous investors are pooled in a specific fund with the aim of achieving a specific objective. Due to the nature of the investment, yield and potential yields cannot be guaranteed. Any income or loss arising from market fluctuations and price volatility of securities held by a mutual fund, even if invested in government securities, is for the account of the investor. As such, shares or units of participation of the investor in a mutual fund, when redeemed, may be worth more or be worth less than his/her initial contribution. Historical performance, when presented, is purely for reference purposes and is not a guarantee of future results. BPI Investment Management, Inc. (BIMI), as fund manager of the ALFM Funds, is not liable for losses, other than due to willful default, evident bad faith or gross negligence. Investors are advised to read the Prospectus of the relevant ALFM Fund which may be obtained from authorized distributors before deciding to invest. For inquiries and comments, visit the BIMI’s website.

UITFs and mutual funds are NOT DEPOSIT products. Earnings are not assured and principal amount invested is exposed to risk of loss. These products cannot be sold to you unless the benefits and risks have been thoroughly explained. If you do not fully understand these products, do not purchase or invest. These products are not an obligation of, or guaranteed, or insured by BPI AMTC (as trustee and fund manager of the BPI Invest and Odyssey UITFs), or BPI Investment Management Inc. (as fund manager of the ALFM Funds), or Bank of the Philippine Islands (BPI) or its affiliates or subsidiaries, and are not insured by the Philippine Deposit Insurance Corporation (PDIC).

BPI AMTC and BIMI are subsidiaries of the Bank of the Philippine Islands (BPI). BPI, BPI AMTC and BIMI will never ask to verify or divulge your personal information such as your user ID, password and OTP (One-Time PIN) via phone, call, text messages (SMS) or link provided in emails. If you receive a call or email asking you to provide any confidential information, do not engage. Immediately change your online banking password and report the incident to 889-10000.

BPI AMTC is regulated by the Bangko Sentral ng Pilipinas. Visit the BSP website for more details.